Understanding the Lewis County Tax Map: A Comprehensive Guide

Related Articles: Understanding the Lewis County Tax Map: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Understanding the Lewis County Tax Map: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the Lewis County Tax Map: A Comprehensive Guide

The Lewis County Tax Map, a vital tool for navigating property information, serves as a comprehensive database containing detailed information about each parcel of land within the county. This map is not merely a visual representation; it is a powerful resource for understanding property boundaries, ownership, tax assessments, and other crucial details. Understanding the Lewis County Tax Map is essential for anyone involved in real estate transactions, property management, or simply seeking information about land ownership in the county.

The Importance of the Lewis County Tax Map

The Lewis County Tax Map plays a crucial role in various aspects of county administration and public life:

- Property Assessment and Taxation: The map forms the foundation for property assessments, ensuring fair and accurate taxation across the county. It allows the assessor to determine the value of each property, considering factors like size, location, and improvements, leading to equitable tax burdens.

- Real Estate Transactions: The map is indispensable for real estate professionals and individuals involved in buying, selling, or transferring property. It provides clear boundaries and ownership information, facilitating smooth transactions and minimizing disputes.

- Land Development and Planning: The map serves as a guide for developers, planners, and government officials in making informed decisions about land use, zoning, and infrastructure development. It provides a clear picture of existing land ownership and potential limitations.

- Emergency Response and Public Safety: The map is invaluable for emergency responders, aiding them in locating properties, identifying hazards, and coordinating response efforts. It provides vital information about property boundaries, access points, and potential risks.

- Public Access to Information: The Lewis County Tax Map makes property information readily available to the public, promoting transparency and empowering citizens to access critical data about their community.

Navigating the Lewis County Tax Map

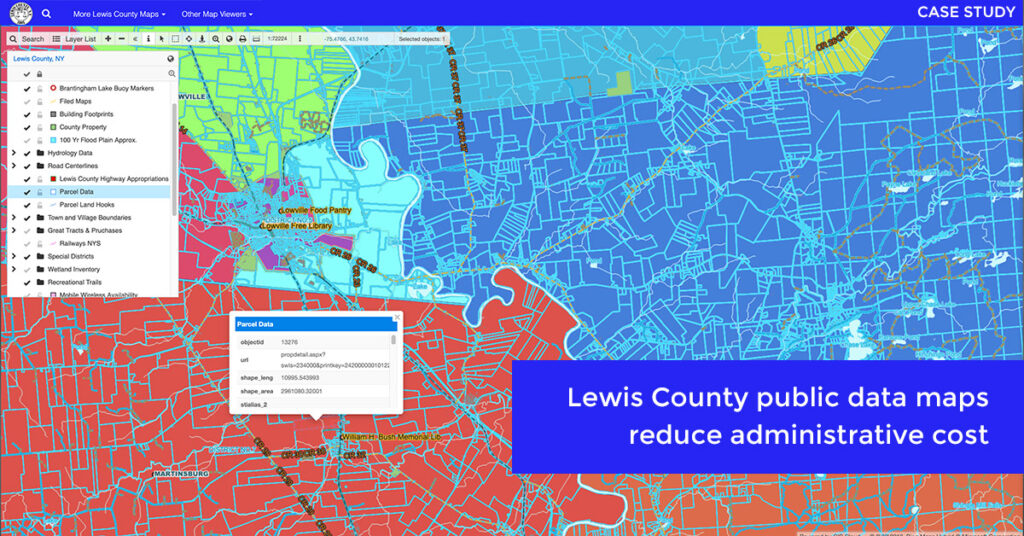

The Lewis County Tax Map is typically presented in a digital format, often accessible through the county website or dedicated online platforms. The map interface usually allows users to:

- Search by Property Address: Users can input a specific property address to view its corresponding parcel information.

- Search by Parcel Number: The map may include a search function using the unique parcel number assigned to each property.

- Zoom and Pan: The map interface allows users to zoom in and out of specific areas and pan across the map to explore different regions.

-

View Property Details: Clicking on a specific parcel typically displays detailed information, including:

- Parcel Number: A unique identifier for the property.

- Owner Name: The current owner of the property.

- Property Address: The official address of the property.

- Acreage: The total area of the property in acres.

- Tax Assessment: The assessed value of the property for tax purposes.

- Zoning Information: The zoning classification assigned to the property.

- Property History: Some maps may include historical information about ownership changes and property transactions.

Accessing the Lewis County Tax Map

The Lewis County Tax Map is typically accessible online through the county website or a dedicated mapping platform. The specific location and method of access may vary depending on the county. It is recommended to visit the Lewis County website or contact the county assessor’s office for detailed instructions on accessing the map.

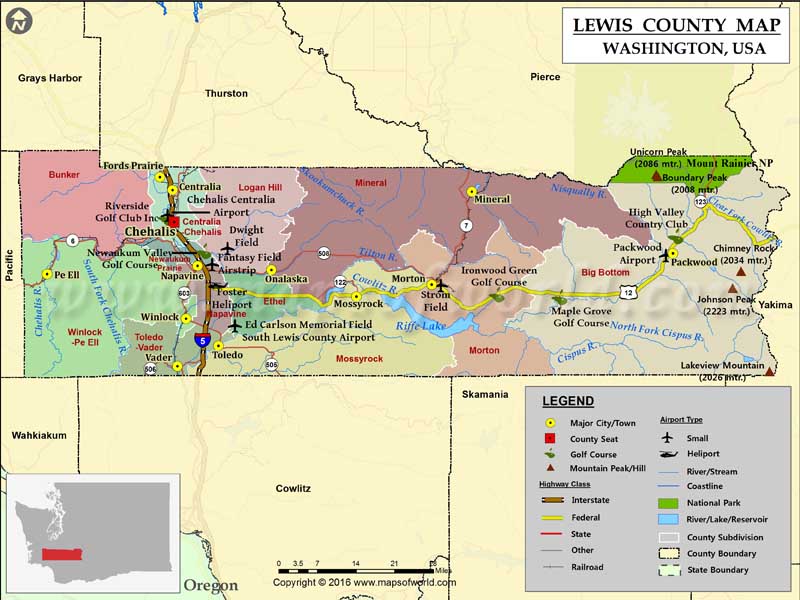

Understanding the Map’s Symbols and Conventions

The Lewis County Tax Map employs various symbols and conventions to represent different features and information. Understanding these symbols is crucial for interpreting the map effectively. Common symbols include:

- Parcel Boundaries: Lines representing the legal boundaries of each property.

- Roads and Streets: Lines indicating roads and streets within the county.

- Water Bodies: Blue lines or shaded areas representing rivers, lakes, and other water features.

- Property Markers: Symbols representing specific features within a property, such as buildings, wells, or septic systems.

- Legend: A key that explains the meaning of different symbols used on the map.

Using the Lewis County Tax Map for Property Research

The Lewis County Tax Map is a valuable resource for anyone conducting property research. Here are some common uses:

- Property Valuation: The map can provide insights into the assessed value of properties in a specific area, helping to estimate market value.

- Property Boundary Verification: The map clarifies property boundaries, preventing disputes and ensuring accurate measurements.

- Zoning and Land Use Regulations: The map identifies zoning classifications and land use restrictions for specific properties.

- Property History: Some maps may provide historical information about ownership changes and property transactions.

- Neighborhood Analysis: The map can be used to analyze property values, demographics, and other factors within a neighborhood.

FAQs about the Lewis County Tax Map

1. What is the purpose of the Lewis County Tax Map?

The Lewis County Tax Map serves as a comprehensive database of property information, encompassing boundaries, ownership, assessments, and other crucial details. It supports property assessment and taxation, real estate transactions, land development, emergency response, and public access to information.

2. How can I access the Lewis County Tax Map?

The Lewis County Tax Map is typically accessible online through the county website or a dedicated mapping platform. The specific location and method of access may vary depending on the county.

3. What information is available on the Lewis County Tax Map?

The map provides detailed information about each parcel, including parcel number, owner name, property address, acreage, tax assessment, zoning information, and property history.

4. How is the Lewis County Tax Map used for property assessment?

The map forms the basis for property assessments, allowing the assessor to determine the value of each property based on factors like size, location, and improvements.

5. Can I use the Lewis County Tax Map for real estate transactions?

Yes, the map is essential for real estate professionals and individuals involved in buying, selling, or transferring property. It provides clear boundaries and ownership information, facilitating smooth transactions.

6. How can I find property boundaries on the Lewis County Tax Map?

Parcel boundaries are typically represented by lines on the map, clearly defining the limits of each property.

7. What are the symbols and conventions used on the Lewis County Tax Map?

The map uses various symbols to represent features and information, such as parcel boundaries, roads, water bodies, and property markers. A legend explains the meaning of each symbol.

8. Is the Lewis County Tax Map updated regularly?

Yes, the map is typically updated regularly to reflect changes in property ownership, boundaries, and other relevant information.

Tips for Using the Lewis County Tax Map

- Familiarize yourself with the map’s interface: Take some time to understand the map’s search functions, zoom controls, and other features.

- Explore the map’s legend: Pay attention to the symbols used on the map and their corresponding meanings.

- Use the map’s search functions effectively: Utilize the search options to locate specific properties or areas of interest.

- Verify information with other sources: While the map is generally reliable, it’s always a good practice to confirm information with other sources, such as official property records.

- Contact the county assessor’s office for assistance: If you have any questions or need further clarification, don’t hesitate to contact the county assessor’s office.

Conclusion

The Lewis County Tax Map is a valuable resource for individuals, businesses, and government agencies, providing a comprehensive and accessible database of property information. By understanding the map’s features, symbols, and conventions, users can access critical data about land ownership, boundaries, assessments, and other relevant details. Whether for real estate transactions, property management, land development, or simply gaining insight into the county’s land holdings, the Lewis County Tax Map serves as a vital tool for navigating the complexities of property information.

Closure

Thus, we hope this article has provided valuable insights into Understanding the Lewis County Tax Map: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!