Understanding Carry Maps: A Guide to Navigating Investment Portfolios

Related Articles: Understanding Carry Maps: A Guide to Navigating Investment Portfolios

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Understanding Carry Maps: A Guide to Navigating Investment Portfolios. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding Carry Maps: A Guide to Navigating Investment Portfolios

In the complex world of investment, navigating a portfolio’s performance and risk can be daunting. This is where a carry map comes into play, offering a powerful tool for visualizing and understanding the intricate relationship between risk, return, and investment strategies.

Defining the Carry Map

A carry map is a visual representation of a portfolio’s performance, primarily focused on the relationship between risk and return. It graphically depicts the various investment strategies employed within a portfolio, highlighting their respective contributions to overall performance and risk. By visualizing these relationships, the carry map provides valuable insights into a portfolio’s underlying structure and its potential for future performance.

Key Components of a Carry Map

A typical carry map consists of several key components:

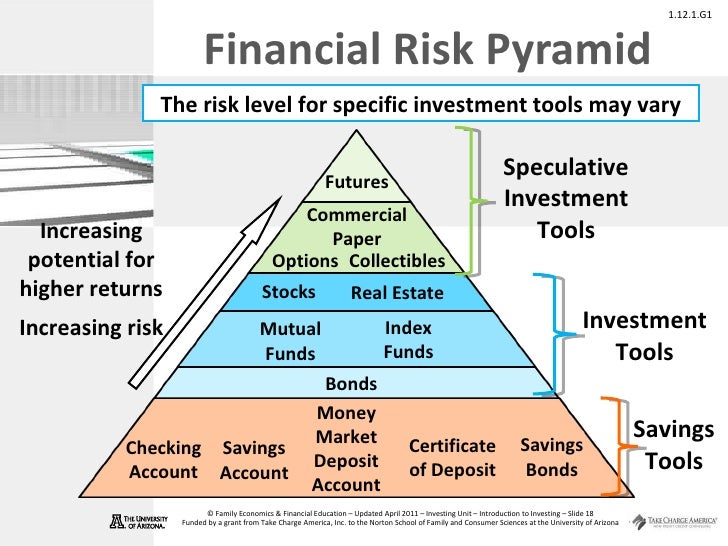

- Risk: This axis represents the volatility or uncertainty associated with an investment strategy. Higher risk typically implies the potential for greater returns but also a higher chance of losses.

- Return: This axis represents the expected profit or loss from an investment strategy. Higher returns are generally associated with higher risk.

- Investment Strategies: Each strategy is represented by a distinct point on the carry map, with its position determined by its risk and return characteristics.

- Carry: This refers to the difference between the return and the cost of capital associated with a particular investment strategy. It essentially measures the profitability of a strategy after accounting for its associated costs.

Understanding the Value of Carry Maps

Carry maps offer several advantages for investors and portfolio managers:

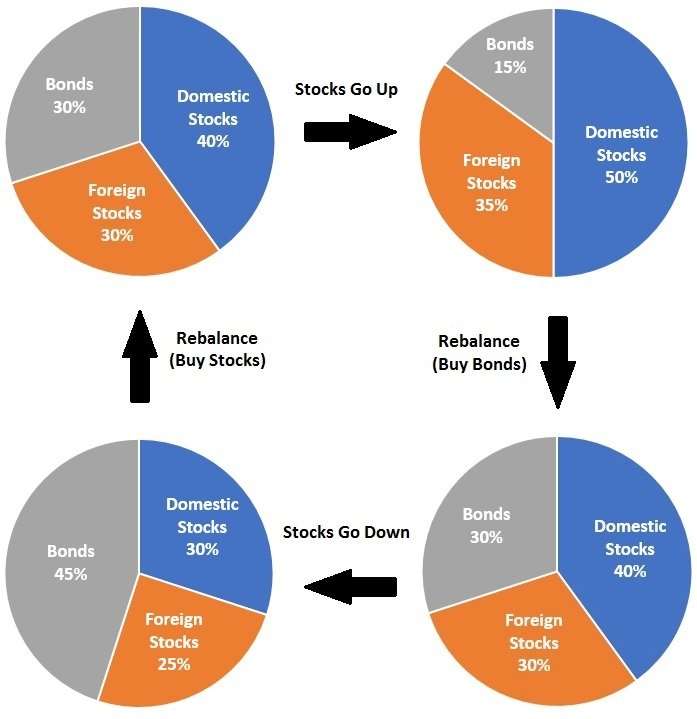

- Portfolio Optimization: By visualizing the risk-return profile of each investment strategy, carry maps enable portfolio managers to identify areas for optimization. They can adjust the allocation of funds across different strategies to achieve the desired risk-return balance.

- Strategic Insights: Carry maps provide a comprehensive overview of a portfolio’s structure and performance, highlighting the key drivers of returns and risks. This allows investors to understand the underlying logic behind the portfolio’s design and its potential for future performance.

- Risk Management: Carry maps facilitate a better understanding of the portfolio’s overall risk exposure. By identifying the strategies contributing most to risk, managers can develop targeted risk management strategies.

- Performance Attribution: Carry maps help attribute the portfolio’s overall performance to individual investment strategies, providing insights into the effectiveness of each strategy and the potential for improvement.

- Investor Communication: Carry maps can be used to effectively communicate investment strategies and performance to clients, providing a clear and concise visual representation of the portfolio’s risk-return profile.

Practical Applications of Carry Maps

Carry maps are widely used in various investment contexts, including:

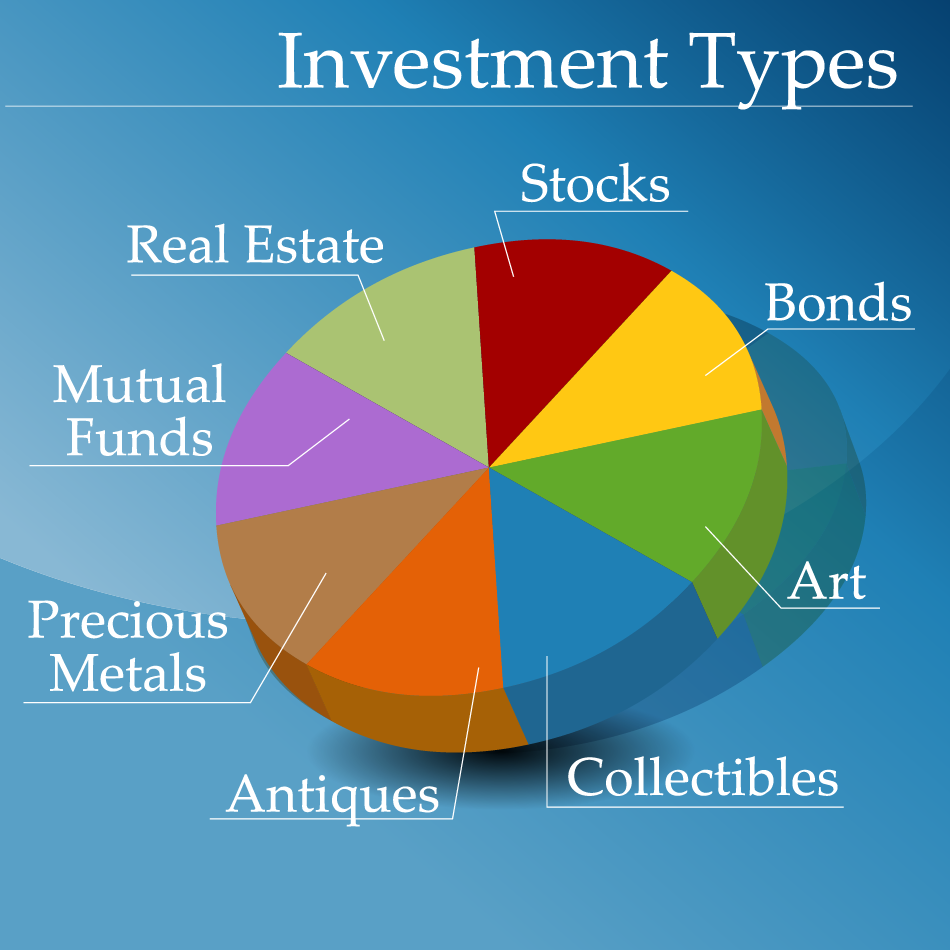

- Hedge Fund Management: Hedge funds utilize carry maps to analyze their complex trading strategies, identify potential areas for improvement, and effectively communicate their investment approach to investors.

- Private Equity: Private equity firms use carry maps to assess the risk-return profile of their investments, evaluate potential acquisitions, and manage their portfolio’s overall risk exposure.

- Real Estate Investment: Real estate investors use carry maps to analyze the risk and return characteristics of different property types and investment strategies.

- Fixed Income Management: Bond managers employ carry maps to assess the yield curve, identify opportunities in the bond market, and manage their portfolio’s interest rate risk.

Building a Carry Map

Creating a carry map involves several steps:

- Defining Investment Strategies: Clearly identify the different investment strategies employed within the portfolio.

- Estimating Risk and Return: Determine the expected risk and return for each strategy based on historical data, market analysis, and expert opinion.

- Plotting Strategies: Represent each strategy on the carry map by plotting its risk and return characteristics.

- Analyzing the Map: Analyze the positions of different strategies on the map, identifying areas of high risk and low return, high return and high risk, and so on.

- Making Adjustments: Based on the analysis, adjust the portfolio’s allocation across different strategies to achieve the desired risk-return profile.

FAQs on Carry Maps

Q: What are the limitations of carry maps?

A: While powerful, carry maps are not without limitations. They rely on historical data and assumptions about future performance, which may not always be accurate. Additionally, they do not account for all factors that can influence portfolio performance, such as market sentiment, regulatory changes, and unforeseen events.

Q: How often should carry maps be updated?

A: The frequency of updating carry maps depends on the portfolio’s complexity and the volatility of the underlying markets. Generally, it is advisable to update the map at least quarterly to reflect changes in market conditions and portfolio composition.

Q: What are some alternative tools for analyzing portfolio performance?

A: Besides carry maps, other tools for analyzing portfolio performance include risk-return matrices, performance attribution models, and scenario analysis. Each tool provides different insights into the portfolio’s characteristics and potential for future performance.

Tips for Using Carry Maps Effectively

- Use consistent data: Ensure that all data used to create the carry map is consistent and reliable.

- Consider all relevant factors: Include all relevant investment strategies and risk factors when constructing the map.

- Focus on long-term performance: Carry maps are most effective when used to analyze long-term investment strategies.

- Regularly review and update: Regularly review and update the carry map to reflect changes in market conditions and portfolio composition.

- Use it as a tool for communication: Use the carry map to effectively communicate investment strategies and performance to clients.

Conclusion

Carry maps provide a powerful tool for visualizing and understanding the complex relationships between risk, return, and investment strategies. By offering a clear and concise representation of a portfolio’s performance and risk profile, they enable investors and portfolio managers to make informed decisions about portfolio optimization, risk management, and strategic allocation. While not without limitations, carry maps remain an invaluable tool for navigating the intricate world of investment and achieving long-term financial goals.

Closure

Thus, we hope this article has provided valuable insights into Understanding Carry Maps: A Guide to Navigating Investment Portfolios. We thank you for taking the time to read this article. See you in our next article!