Navigating the Landscape: Understanding County Tax Maps and Their Importance

Related Articles: Navigating the Landscape: Understanding County Tax Maps and Their Importance

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Landscape: Understanding County Tax Maps and Their Importance. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape: Understanding County Tax Maps and Their Importance

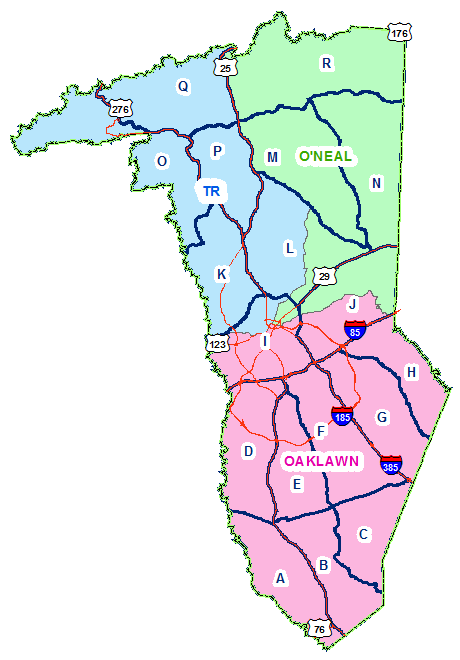

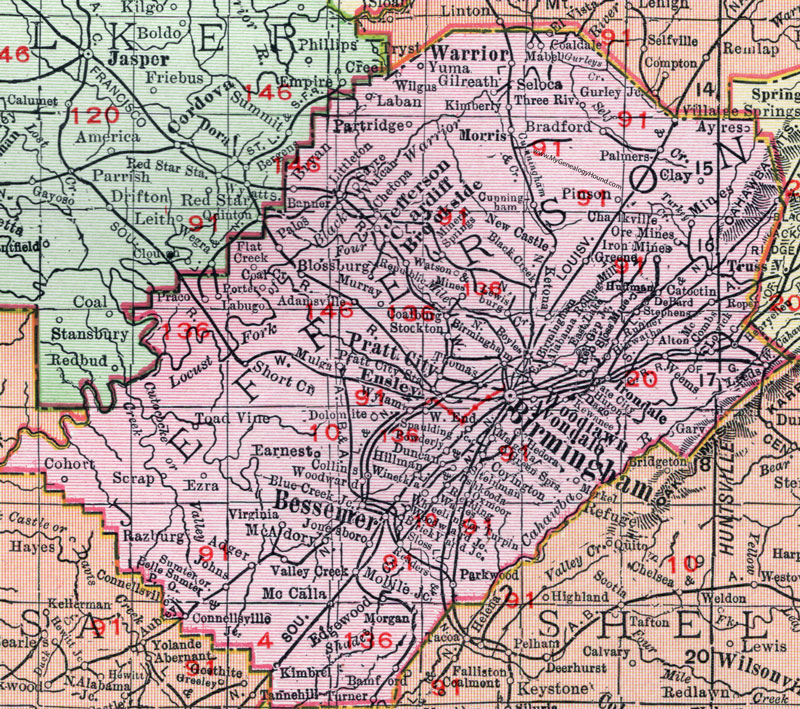

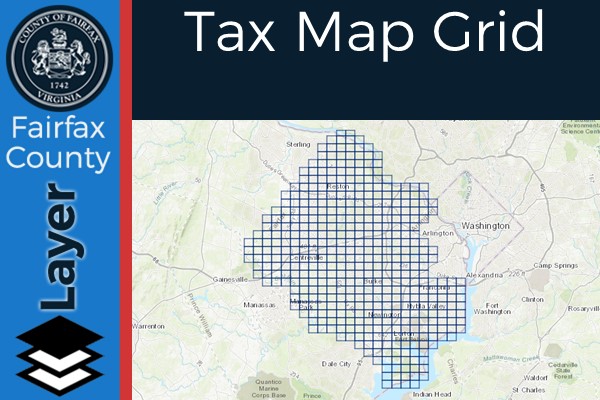

County tax maps, often referred to as property tax maps or assessment maps, are essential tools for understanding the intricate web of land ownership and property valuation within a county. These maps serve as a visual representation of the land, its boundaries, and the associated property details, providing valuable information for a multitude of stakeholders.

A Comprehensive Overview of County Tax Maps

County tax maps are meticulously crafted documents that depict the geographical layout of a county, showcasing individual parcels of land and their associated properties. They are typically created and maintained by county assessors or tax offices, serving as the official record of property ownership and valuation for tax purposes.

Key Features of County Tax Maps

- Parcel Identification: Each parcel of land is assigned a unique identification number, facilitating efficient tracking and referencing.

- Property Boundaries: The maps clearly delineate the boundaries of each property, often using lines or colors to distinguish individual parcels.

- Ownership Information: The maps typically display the names of property owners or legal entities associated with each parcel.

- Property Characteristics: Essential details like property type (residential, commercial, agricultural), acreage, and zoning information are often included.

- Valuation Data: The maps may display the assessed value of each property, which forms the basis for property tax calculations.

The Importance of County Tax Maps

County tax maps are indispensable resources for a wide range of individuals and organizations, playing a critical role in various aspects of county governance and property management:

- Tax Assessment and Collection: The maps are the foundation for fair and accurate property tax assessment. By providing a clear picture of property ownership and value, they ensure equitable distribution of tax burdens.

- Land Planning and Development: County planners, developers, and real estate professionals rely heavily on tax maps to understand land availability, zoning regulations, and property characteristics, facilitating informed decision-making for projects and investments.

- Property Transactions: Buyers and sellers of real estate utilize tax maps to verify property boundaries, identify potential issues, and assess the value of properties before making transactions.

- Public Access and Transparency: County tax maps are often made publicly available, promoting transparency in land ownership and property valuation, fostering public accountability and trust in government processes.

- Emergency Response and Disaster Planning: First responders and emergency management agencies use tax maps to navigate unfamiliar areas, identify property locations, and plan effective responses to emergencies and natural disasters.

Accessing County Tax Maps

County tax maps are typically accessible through various channels:

- County Assessor’s Office: The primary source for accessing tax maps is the county assessor’s office. They often offer online access to maps, as well as in-person viewing and printing options.

- County Website: Many counties provide online access to their tax maps through their official websites, offering interactive features like zooming, searching, and downloading.

- Third-Party Mapping Services: Several private companies offer online mapping services, including access to county tax maps, often with additional features like property history and valuation data.

Understanding County Tax Maps: A Closer Look

To effectively navigate and utilize county tax maps, it’s crucial to grasp the nuances of their structure and interpretation:

- Parcel Numbers: The unique identification numbers assigned to each parcel provide a standardized method for referencing and tracking properties.

- Property Boundaries: The lines or colors used to delineate property boundaries may vary depending on the map’s scale and purpose.

- Property Types and Uses: Understanding the different property types (residential, commercial, agricultural) and their corresponding uses is essential for interpreting the information presented on the maps.

- Zoning Regulations: The maps may indicate zoning classifications, reflecting the permitted land uses and development restrictions within a particular area.

- Valuation Data: The assessed value of a property, often displayed on the map, is determined by the county assessor based on factors like property type, size, condition, and market value.

FAQs about County Tax Maps

1. What is the difference between a county tax map and a property deed?

A county tax map provides a visual representation of property ownership and valuation, while a property deed is a legal document that formally establishes ownership and describes the property boundaries.

2. Can I use a county tax map to determine the market value of a property?

While tax maps display the assessed value of properties, this value may differ from the market value, which is determined by factors like current market conditions and demand.

3. How can I obtain a copy of a county tax map?

County tax maps are typically available for viewing and printing at the county assessor’s office or online through the county website.

4. Are county tax maps always accurate?

County tax maps are generally accurate, but errors can occur due to human error, changes in property ownership, or updates to property boundaries.

5. Can I use a county tax map to determine the legal boundaries of a property?

County tax maps provide a general representation of property boundaries, but it’s crucial to consult a property deed or survey for precise legal boundaries.

Tips for Using County Tax Maps

- Consult the Legend: Pay close attention to the map’s legend, which explains the symbols, colors, and abbreviations used to represent different features.

- Zoom and Pan: Utilize the zoom and pan features of online maps to explore specific areas of interest in detail.

- Search by Address or Parcel Number: Most online maps allow searching by address or parcel number to quickly locate specific properties.

- Verify Information: Always cross-reference information obtained from tax maps with other sources, such as property deeds or assessor records, to ensure accuracy.

- Seek Professional Guidance: If you’re unsure about interpreting tax map data or need assistance with property-related matters, consult a qualified professional like a real estate agent, attorney, or surveyor.

Conclusion

County tax maps are indispensable tools for navigating the complexities of land ownership and property valuation. They provide a visual framework for understanding the intricate relationships between property, ownership, and value, serving as a vital resource for various stakeholders. By comprehending the structure and interpretation of these maps, individuals and organizations can gain valuable insights into the landscape of their county, facilitating informed decision-making and promoting transparency in property-related matters.

.png)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape: Understanding County Tax Maps and Their Importance. We hope you find this article informative and beneficial. See you in our next article!