Navigating Richland County’s Real Estate Landscape: A Comprehensive Guide to the Tax Map GIS

Related Articles: Navigating Richland County’s Real Estate Landscape: A Comprehensive Guide to the Tax Map GIS

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating Richland County’s Real Estate Landscape: A Comprehensive Guide to the Tax Map GIS. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Richland County’s Real Estate Landscape: A Comprehensive Guide to the Tax Map GIS

Richland County, a vibrant hub in the heart of South Carolina, boasts a diverse real estate market. Understanding the intricacies of this market is crucial for residents, businesses, and investors alike. The Richland County Tax Map Geographic Information System (GIS) serves as an invaluable tool in this regard, offering a comprehensive and accessible platform to explore and analyze property data. This article delves into the functionalities, benefits, and nuances of this powerful resource.

The Essence of the Richland County Tax Map GIS

The Richland County Tax Map GIS is an online mapping system that integrates a wealth of property information, presented in a user-friendly visual format. It functions as a central repository of data, encompassing:

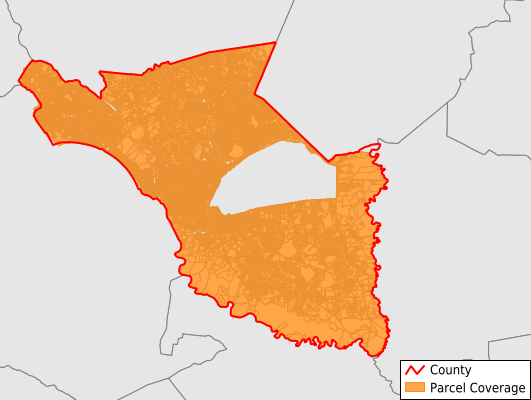

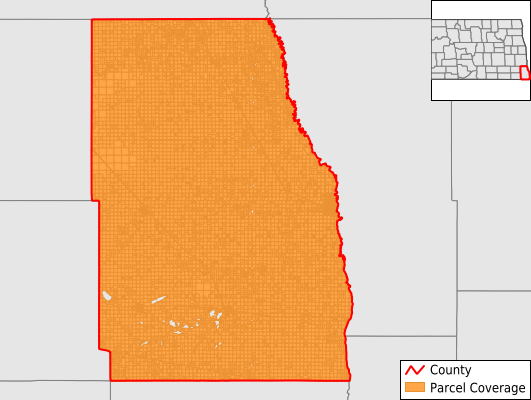

- Property Boundaries: Precisely defined property lines, ensuring clarity in ownership and land use.

- Parcel Identification Numbers (PINs): Unique identifiers assigned to each property, facilitating efficient data retrieval and management.

- Property Ownership: Details of the current property owner, including their name and contact information.

- Property Values: Assessed values for tax purposes, offering insights into property worth.

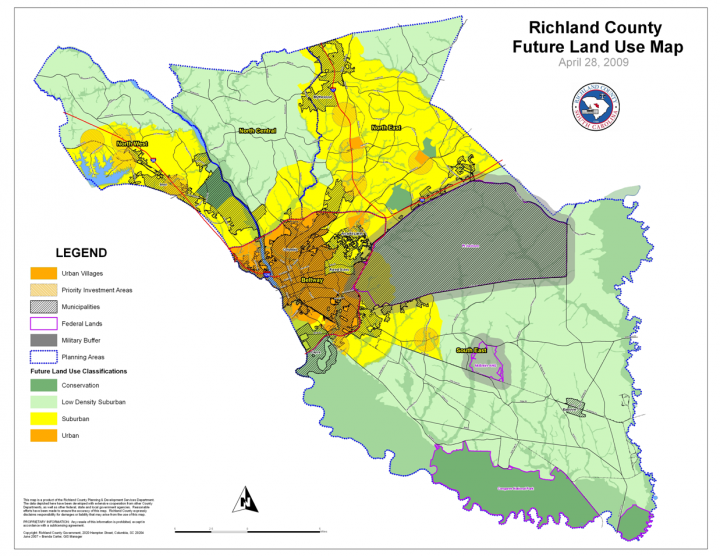

- Land Use: Categorization of property usage, ranging from residential to commercial and industrial.

- Zoning Information: Regulatory guidelines governing land use and development within specific areas.

- Utilities: Information on available utilities, such as water, sewer, and electricity, impacting property suitability.

- Tax Information: Details regarding property taxes, including payment history and outstanding balances.

Unlocking the Power of the Richland County Tax Map GIS

The Richland County Tax Map GIS is not merely a static database; it is a dynamic tool offering a range of functionalities to empower users:

- Interactive Mapping: Users can zoom, pan, and navigate the map to pinpoint specific properties or areas of interest.

- Property Search: Searching by address, PIN, or owner name allows for quick and efficient property identification.

- Data Visualization: The system displays data in various formats, including maps, charts, and tables, enabling users to analyze trends and patterns.

- Downloadable Reports: Users can generate customized reports containing specific property details, facilitating informed decision-making.

- Integration with Other Systems: The GIS seamlessly integrates with other county databases, providing a holistic view of property information.

Benefits of Utilizing the Richland County Tax Map GIS

The Richland County Tax Map GIS offers a multitude of benefits for various stakeholders:

For Homeowners:

- Property Valuation: Provides insights into property values, enabling informed decisions regarding refinancing or sale.

- Property Tax Information: Offers access to tax details, allowing for timely payments and avoiding penalties.

- Neighborhood Analysis: Allows users to explore surrounding properties and understand neighborhood characteristics.

For Businesses:

- Site Selection: Provides crucial information for identifying suitable locations for businesses, considering factors like zoning, utilities, and proximity to infrastructure.

- Market Analysis: Enables businesses to analyze property values, identify growth areas, and assess market trends.

- Property Management: Facilitates efficient property management by offering detailed information on ownership, tax obligations, and land use regulations.

For Investors:

- Investment Opportunities: Identifies potential investment properties based on factors like value, location, and growth potential.

- Due Diligence: Provides comprehensive data for conducting due diligence on potential investments, minimizing risks.

- Market Trends: Allows investors to analyze market trends and identify areas of high demand or future growth.

For Government Agencies:

- Property Assessment: Supports accurate property assessments for tax purposes, ensuring equitable distribution of tax burdens.

- Land Use Planning: Provides data for informed land use planning, promoting sustainable development and community growth.

- Emergency Response: Offers vital information for emergency response teams, facilitating efficient resource allocation and communication.

Navigating the Richland County Tax Map GIS

The Richland County Tax Map GIS is readily accessible through the county’s official website. Users can navigate the system through a user-friendly interface, with intuitive search functions and clear data presentation. The system is regularly updated to ensure accuracy and relevance.

FAQs Regarding the Richland County Tax Map GIS

Q: How do I access the Richland County Tax Map GIS?

A: The Richland County Tax Map GIS is accessible through the county’s official website. The specific link can be found in the "Property Records" or "GIS Services" sections of the website.

Q: What information can I find on the Tax Map GIS?

A: The Tax Map GIS provides a wealth of information, including property boundaries, ownership details, assessed values, land use, zoning, utilities, and tax information.

Q: Can I download data from the Tax Map GIS?

A: Yes, the system allows users to download data in various formats, including reports, shapefiles, and KML files, enabling further analysis and integration with other systems.

Q: What are the limitations of the Tax Map GIS?

A: While the Tax Map GIS is a valuable tool, it is important to note that the data may not always be entirely up-to-date, and certain details, such as recent property sales, may not be immediately reflected.

Q: Who should I contact if I have questions or need assistance with the Tax Map GIS?

A: For assistance with the Tax Map GIS, users can contact the Richland County Assessor’s Office or the GIS Department. Their contact information is usually available on the county’s website.

Tips for Utilizing the Richland County Tax Map GIS Effectively

- Familiarize yourself with the interface: Spend some time exploring the system’s functionalities, including search options, data visualization tools, and reporting features.

- Define your search criteria: Clearly define your search goals to narrow down results and avoid overwhelming data.

- Utilize data filters: Explore the various filters available to refine your search results and focus on relevant information.

- Cross-reference data: Compare information from different sources, such as property deeds or zoning ordinances, to ensure accuracy and completeness.

- Seek assistance when needed: Don’t hesitate to contact the county’s Assessor’s Office or GIS Department for guidance or clarification.

Conclusion

The Richland County Tax Map GIS is a vital resource for understanding and navigating the county’s real estate landscape. Its comprehensive data, user-friendly interface, and powerful functionalities empower residents, businesses, investors, and government agencies to make informed decisions, foster responsible development, and promote a thriving community. By leveraging this valuable tool, stakeholders can effectively access, analyze, and utilize property information, contributing to a more transparent and prosperous Richland County.

Closure

Thus, we hope this article has provided valuable insights into Navigating Richland County’s Real Estate Landscape: A Comprehensive Guide to the Tax Map GIS. We thank you for taking the time to read this article. See you in our next article!